As 2005 comes to an end, I don't think anyone can complain about financial markets this year. Good profits have been made in financial indices, commodities, equities and currencies. Of course, markets are forward pricing and are always asking "what next," so it would be wrong to become too complacent, however, for the rest of 2005 I expect markets to remain in good shape with no serious upsets.

Traders will look to book large profits made so far this year and will become risk adverse to opening new trades as no-one wants to upset year end bonuses.

For now I continue to remain long major market indices including the US Dow Jones, FTSE250 and German Dax. All of these mentioned are at or near 52 week highs. I also remain bullish on Gold and we could still see $550 an ounce in the first quarter of 2006.

At this time of the year many financial experts like to come out with forecasts and targets for the year ahead. I would strongly advise that you ignore these psychic predications, as crystal ball gazing is not the way to make big money in markets. Followers of this column know my style is to trade trends rather than predict moves. I use simple price charts to make a judgement whether an up or down trend is in progress and I bet with the trend until that trend comes to an end.

What I can say is that just as enjoying too much seasonal cheer can leave you worse for ware the current bullish market action will leave many with a soar head in the New Year, but we will worry about that in due course. As I have mentioned in previous columns financial markets do have seasonal bullish biases between November to January, so we are still in a sweet spot, however, experience tells me that a sharp pullback will be due in the early part of 2006.

I don't feature the Japanese Nikki 225 that much however, it could be a market worth looking at in 2006. You can spread bet the Nikki with all major bookmakers from as little as £1 per point. As the chart below shows from 1999 to 2003 this market was in a sharp down trend. Since then we have been in a sideways range with the last few months seeing a breakout of this range. Based on the price action of this chart we can say that Japan is coming back into fashion and the current trend should continue in 2006 and we could see the Nikki back up to 17,000 within the next 6 to 8 months from the current 14,500 level.

|

It's been a long time coming with many false starts but the Japanese economy is finally starting to look better with overseas investment returning to Japan which look fair value compared to the USA. Also the weaker Yen and stronger US Dollar is also helping Japan to become more competitive again with Economic growth re-started, a supportive government, companies with healthy balance sheets, low unemployment, deflation nearly defeated and early signs of consumers spending. The opportunity is that while this has begun to show up in earnings, it has yet to be fully valued in the market. One measure that captures both the PEG ratio (forward P/E over the forward EPS growth estimate), shows Japan to be the most attractive developed market. Currently on a PEG of 1 compared to the US on 1.4.

Of course after the current strong run up of over 36% since the May 05 low, the Nikki 225 will see some sharp corrections along the way, but I would expect pull backs to be short with the index moving higher. I would suggest a small spread bet with a larger stop so that you can avoid the short term whipsaws.

The FTSE250 is still not really followed. All the media quote the FTSE100 at the end of news bulletins, however, the FTSE250 is doing far better than its big brother. Since the October 05 lows the FTSE100 is up over 7%, but the FTSE250 is up over 12% and continues to look strong. I have mentioned the FTSE250 here in the past and you can spread bet this index in the normal way. What I think has put a few traders off is the wider spread, however, if you are trend trading as I do rather than trying to job in and out of the market then the wider spread is not a big deal. I urge you to take a look at the FTSE250 as a serious trading tool. It gives you a fast way to get exposure to UK stocks either Long or Short.

That's it for this month and this year. Seasons greetings to you all and looking forward to a very prosperous 2006.

The last time I featured gold was in my June column when Gold was at $420 an ounce. Since then we have moved up nicely to $455 and the prospects of higher prices look very good. If you don't have exposure to Gold, then you need to be quick as all my charts point to gold hitting $500 an ounce before Christmas. It is very possible that we could even see $600 in the next 6 months.

As a few funds are cutting their exposure and taking profits from recent surging oil prices, Gold seems to be the next market to benefit. It's interesting to see how money just flows from one market to another and just as the public start to buy in, then the smart money is on to the next market. As we saw with Oil prices, once resistance levels are taken out, then prices move up very quickly, hence why I think that the move from $500 to $600 could be very quick, just as Oil moved from $50 to $70.

The total Gold market is not that big so we could really see some crazy moves up, without large amounts of money coming in. A stampede of hedge funds and trend traders all hitting the gold market at once can easily make the Gold market rocket.

As many of you know I mainly trade on price rather than fundamentals, so I am not concerned about asking Why the Gold market is moving higher and why now? All I know is that the price is moving higher and you have to go with the trend. We know that crowds and perceptions are more important than the actual reality.

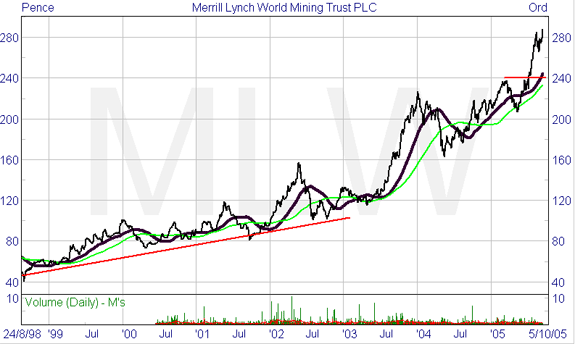

The easiest way to back Gold is with a Spread Bet, you would currently look to bet the December contract. A way to profit is to spread bet individual shares or an investment trust. The advantages of spread betting an investment trust is that you get exposure to more than one company, but still in one trade. Take a look at Merrill Lynch Worldwide Mining (MLW). This is listed on FTSE250 and you can spread bet in the same way as any share. The great advantage of using a spread bet is that it's Tax Free.

|

Looking at the chart it's easy to think that you are too late, but as I have stated before shares that hit new 52 week highs tend to carry on going up. Another share with interests in various mining companies to look at is Peter Hambro Mining (POG), just a few points of its 52 week high, interesting to note that MLW owns around 6% of Peter Hambro.

Markets have held up better than expected especially the FTSE100. September and October are normally my best months to be short the markets, but this year markets are holding up better than expected. The Bulls are not home and dry yet. They still have the rest of October to get through. My view is that I still expect a pull back in stock indices both is the USA and Europe before a seasonal year end rally starting towards the end of November.

Investors seem to be very complacent to the various financial risks. Oil staying up at $50+ still seems to have not sunk in yet. The effects on doing business and consumer spending has not filtered down the line yet, but it will do soon. If you are spending £10 extra a week to fill up your car then that has to come from somewhere, and in most cases it will be spending that is cut back. Shares of clothing retailers Next (NXT) have had a great run and the management have done a great job here, but the charts are starting to show that the best is over for now. After hitting £16 a share, Next looks like it's on the way back to £12 and is one worth looking to go short.

With higher energy prices filtering in to heating bills as well as petrol, this Christmas is going to be very hard for retailers. A budget retailer which could do well is Instore (INST) formally known as Brown & Jackson, as shoppers look for better value.

Until next month happy trading,

Vince Stanzione

Since my last column we are all aware of the tragic event of the 7th July in London and a new sense of uncertainty which faces all major cities in the UK. This month I will take a look at companies that stand to benefit from this new environment of terror and how markets are coping. I would also like to address the issue of guaranteed stops and making sure that you are protected in unforeseen circumstances.

Many traders are surprised at how well the FTSE100 has held up, after a knee jerk sell off, markets have now moved higher. I would however warn about becoming complacent, should another major attack occur in London then I would not expect the markets to be so forgiving. Much of the FTSE strength is still related to Oil heavy weights such as BP and Royal Dutch Shell. If you look at a chart of BP and FTSE100 you will see similarities. If these heavy weights start to weaken then the FTSE will follow suit but for now UK indices continue to be in a strong up trend and as long as the FTSE100 stays above its 50 day moving average, currently around 5,100 then you would stay Long. On the FTSE250 again good strength and in fact the FTSE250 is now higher than at its Dot Com peak in 2000. As long as the FTSE250 stays over its 50 day moving average which is around 7,300 then the trend remains up.

Traders should be careful this month as we are in the peak of the holiday session and I would expect trading volumes to come down. With thin volumes we may see exaggerated moves in share prices. For the US S&P500 market August tends to be a flat to weak month. September is normally a very weak month.

One advantage of spread betting is the ability to set a guaranteed stop loss (controlled risk bet). Let me just re explain the difference between a guaranteed stop loss and normal stop loss. When placing a trade regardless of the market, share, or commodity it makes sense to set a stop loss. So if the trade does not go your way you have an instruction placed with the financial bookmakers to close the trade at a set level. With a normal stop loss the bookmakers will do their best to get you out at or near the price. With a guaranteed stop loss the bookmakers will guarantee to get you out at the set level. In return for this extra insurance you will be charged around 4 points extra spread. In normal market conditions this may seem expensive but as demonstrated in the wild swings of the 7th July having a guaranteed stop lose does make sense.

If you do not have a guaranteed stop and markets move very quickly the price your bet will be closed out at may be very different to what you expected. I don't think you need to go for a guaranteed stop loss on currencies as these markets trade 24 hours and have a massive amount of liquidity so a normal stop loss is sufficient.

As a provider of security guards with major contracts covering airports, Government buildings and private companies its not surprising that this chart is looking positive. Spending by both private and government sectors will need to rise in the coming years and Securicor will see some of this money. Expect to see more airport style security in public buildings in coming months. Another smaller company to look at is Reliance Security Group (RSG).

|

Shares that I would be careful of at present are those companies with commercial property exposure especially in London. Hammerson (which has had a great run and are the owners of Brent Cross Shopping Centre, offices in Docklands and the City are starting show fatigue, could be a possible short trade. Land Securities (LAND) another share which has done very well in the last few years, however, is also starting to find resistance.

Gold has been a bit out of focus in the last few months. As the US Dollar has been strengthening the price of Gold for foreign investors (Gold is priced in dollars) has become more expensive. However, the fact that gold is holding over $400 an ounce is impressive and signals to me that the next move in Gold is back up to $460 and maybe $480 before the end of the year. It could be worth having a small spread bet on December Gold with a stop at say $407 and just letting the bet run for the next few months. I mentioned earlier that September tends to be a weak month for the S&P 500, well September tends to be a strong month for Gold, so if US stocks do move lower in September this will help Gold move higher.

Until next month wishing you lots of success with your trading.

Vince Stanzione

Remember when you were a child and you went into a sweet shop with a limited amount of pocket money. Chances are you would be weighing up your options and try to stretch you money as far as possible. So what have the days of Blackjacks and Fruit Salads got to do with spread betting and trading?

Well in current market conditions where we don't really have a strong or weak overall stock market we need to be picky and we need to think twice before we trade once. If we look underneath the surface of the FTSE100 we can see many defensive companies making new 52 week or all time highs.

Shares currently showing good strength in the FTSE100 include British American Tobacco, United Utilities, Severn Trent, Alliance Unichem, Reckitt Benckiser and Glaxo. As I have mentioned before, just because a share hits a 52 week high or an all time high, does not mean it cannot go higher. Always buy strength, sell weakness. So whilst the FTSE100 has not done much this year so far these shares are up over 20% each in most cases. On the downside Man Group, Corus, Compass Group and Antofagasta are all down around 20%.

Using a charting program such as Sharescope, allows you to easily filter for strength and weakness. Of course you can find new 52 week highs and lows in the Financial Times and do it by hand but it's easier to press a few buttons.

A few months ago I warned about the bubble in various mining and natural resource companies. Since then we have seen most of the hot mining shares come off their highs. I see no reason to step in and buy any of these mining stocks until at least September.

Carpetright has had a great run going from £6 to the high of £12 in a fairly steady fashion however the writing is on the wall or should I say in the chart. Remember in most cases the price tells us what is really happening, by the time the news is out its too late.

|

After a great run we can see that all is not well with the Carpetright chart. The first sign of trouble is when the price breaks below the 200 day moving average at £11.

So lets use this as a good case study to learn from and to remember "cut your losses and let your winners run". On around the 15th March 2005 we see the price moves below the 200 day moving average which is a sign of weakness. We then see the price continue to drift lower break through £10, £9 and finding some support at £8. Based on what I see here the next move for Carpetright is down and back to £6.

There are plenty more retailers out there that are showing weakness, as a nimble spread trader we can look to short these shares. Just following a simple chart will make sure you can ride these shares on the way up but when the tide turn you are ready to cut and run. Take a look at House of Fraser (HOF) as another possible short trade this month.

Until next month wishing you lots of success with your trading.

Vince Stanzione

Vince Stanzione is a major name in the UK spread betting industry, having generated a reputation for making millions of GBP pounds tax free with a simple style he now sells as both a mail order course and a 1 day seminar, usually thru his FinTrader.net operation.

Opinion seems to be divided on whether or not Vince's style is anything original - his mail order course (costing several hundred pounds GBP) seems to be nothing more than a ring-bound folder containing a basic 'beginner's guide to trading (explaining such concepts as 'moving averages', stop losses, how to open a spread betting account and so on). On the other hand, although the same information may be available in a few manuals from Amazon for 40 or 50 bucks, Mr Stanzione has assembled it into one easy course, which will probably save a beginner much time and effort at the start of their trading career. Stanzione's reputation in the various online trading forums is both attacked and defended with equal vigour.

YOU SHOULDN'T SPEND MORE THAN GBP500 TO ATTEND A WORKSHOP OR SEMINAR NOT EVEN IF THEY PROMISE YOU GOLD FOR ATTENDING

The "Ads by Google" are just ads and help support the free information aspect of this site. You'll have to do your own research to decide whether those companies are reliable or not.The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.